Category: External Resources

-

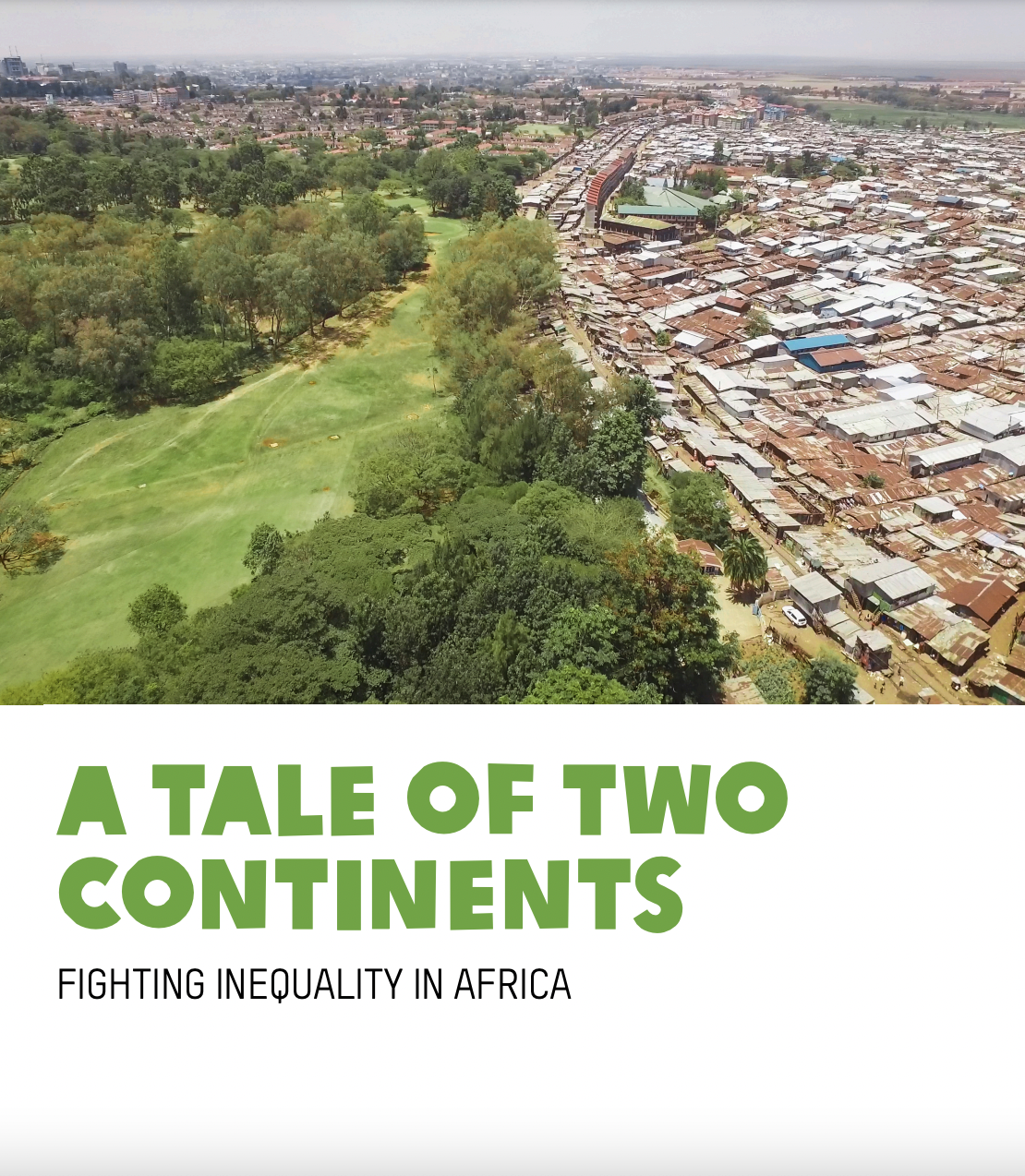

Report launch: “A Tale of Two Continents: Fighting inequality in Africa”

On September 3rd (2019), Oxfam launched the briefing paper “A Tale of Two Continents: Fighting Inequality in Africa” during The World Economic Forum on Africa Meeting in Cape Town, South Africa. The briefing paper discusses how, despite the recent spate of economic growth, the African continent remains afflicted by entrenched poverty and alarmingly high and…

-

Taxes, Taxes, Taxes… Their importance explained

Even though it is a while ago, the appearance of Rutger Bregman at the World Economic Forum meeting in Davos is still relevant. He addressed the issue of tax avoidance by big multinationals at the meeting where the richest CEOs, politicians and intellectuals gather yearly to talk about…well, anything but taxes. Why are taxes so…

-

Tax avoidance and evasion through double taxation agreements is eroding Uganda’s tax base

A Civil Society statement, released by the Tax Justice Alliance and SEATINI-Uganda, expresses concern regarding corporations dodging tax using the Uganda-Mauritius Double Taxation Agreement. Double Taxation Agreements (DTA) are a tool used by countries to avoid double taxation of individuals and companies operating in more than one country. However, DTAs have become a way for multinational…

-

Launch of the Fair Tax Monitor and the Commitment to Reducing Inequality Index report in Nigeria

Today, Oxfam in Nigeria joins the rest of the world to mark the World Day of International Justice with the launch of the Fair Tax Monitor report as well as the Commitment to Reducing Inequality Index (CRII) report in Abuja, Nigeria. The Fair Tax Monitor (FTM) is a research and advocacy tool developed jointly by…

-

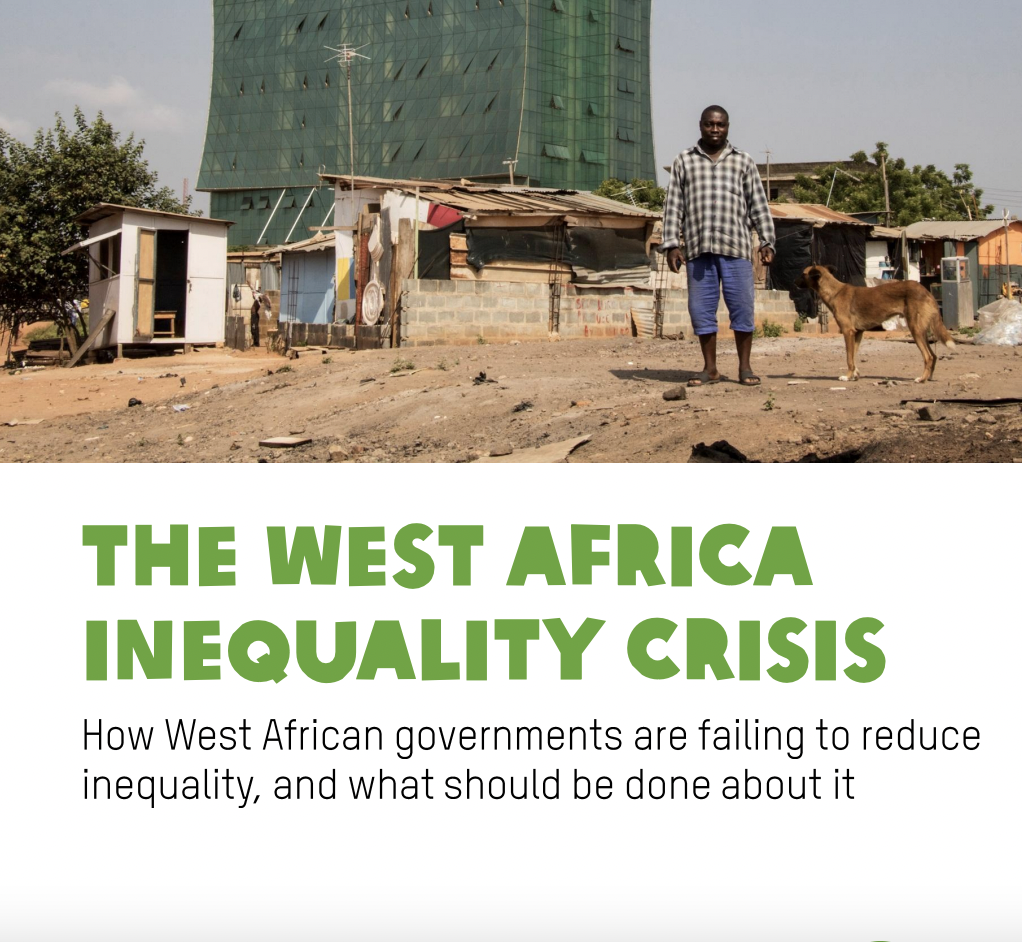

Launch of the WAF Commitment to Reducing Inequality Report (CRII)

West African Governments are the least committed to reduce inequalities in Africa Oxfam and Development Finance International have launched the first ever Commitment to Reducing Inequality Index (CRII) regional report. The index measures, compares and ranks West African governments’ commitment on 3 pillars: public spending, taxation, and labour markets. The report also includes a regional analysis…

-

MIFTAH Launches Fair Tax Monitor OPT

On April 10th 2019, Oxfam’s partner MIFTAH launched the Fair Tax Monitor OPT . The FTM report aims to provide the Palestinian public and civil society organizations with an overview of the national tax system. The FTM relies on publicly available data on the tax burden, distribution of taxes and management of tax administration to…

-

Beans and Ugali for Ugandan Politicians

Launch Fair Tax Monitor in Uganda big success Millions of Ugandans now know that the tax system in Uganda is not fair. The launch of the Fair Tax Monitor by Oxfam and partner SEATINI at the end of January was on the biggest national private television in Uganda (NTV), the radio and debated in many…

-

Launch of the Fair Tax Monitor in Uganda

Oxfam and SEATINI Uganda are launching a study entitled Fair Tax Monitor Study: Uganda.

-

Can You Open Fiscal Space by Closing Civic Space?

Not if you want domestic revenue mobilization to succeed…

-

Fair Tax Monitor Strategic Reflection and Review Workshop

From 3 to 5 September the Oxfam FTM team in collaboration…

-

TJNA Press Release on AU Experts Meeting on Finances

The Tax Justice Network Africa called for greater focus on untapped assets…

-

Stakeholders Dialogue on Double Taxation Treaties in Uganda

SEATINI Uganda, OXFAM in Uganda and Tax Justice Network Africa…

-

Review of TADAT’s Effectiveness in Uganda

With the support of Oxfam Uganda, SEATINI Uganda convened…

-

Even It Up: Tackling Inequality in Nigeria Through Analysis and Advocacy

Early February Oxfam collaborated with BudgIt Information Technology Network Lagos…

-

Students Join In Campaign Against Illicit Financial Flows

The fight against illicit financial flows today received a boost…

-

The World Bank’s Incoherent Approach to Taxes

The World Bank should revise its Doing Business report…

-

Global Alliance for Tax Justice – Highlights of 2017

Both Oxfam Novib and Tax Justice Network – Africa are very proud to be part of…

-

The Heist No One Is Talking About

Oxfam recently released an impactful video titled…

-

African Finance Ministers Sign Yaoundé Declaration

Recently, in the margins of the 10th Global Forum meeting on Transparency and…

-

Paradise Papers: Who’s Next?

You have probably heard a lot about the Paradise Papers…

-

IMF Fiscal Monitor: Tackling Inequality

Excessive inequality can have a severe impact on societies…

-

Fair Tax Monitor session at Oxfam Evidence for Influencing Conference

The Fair Tax Monitor team was present during the Evidence for Influencing Conference organized by the Oxfam Research Network.

-

TJNA’s Africa Media Training 2017

The theme of the 2017 edition of TJNA’s annual Africa Media Training was ‘Harnessing Africa’s mineral wealth to finance sustainable development’.

-

PWYP Australia: Abundant Resources, Absent Data

Publish What You Pay Australia recently published a report titled…

-

The World Needs CFC Rules That Tax Profits Where Value Is Not Created

In his blog on Kluwer International Tax Blog Francis Weyzig…

-

Tax Incentives and the African Education Finance Gap

How much revenue do African governments lose from providing tax incentives…

-

Fight Inequality Mobilisation Week

Extreme inequality of power and wealth in the hands of wealthy companies…

-

Third International Conference on Tax in Africa

The Third International Conference on Tax in Africa took place from the 27th to 29th of September, a biannual event which was held in Abuja, Nigeria. At this 3-day flagship conference of the African Tax Administration over 38 members of African revenue authorities and tax experts from all over the world deliberated on “Building Strong Domestic…

-

Bermuda: We Are Not a Tax Haven

Guest blog by Francis Weyzig, senior policy advisor for fair tax at Oxfam Novib In a highly entertaining Dutch TV documentary, small entrepreneur Jan sets out to minimize his tax bill. That’s easier said then done! Jan quickly finds out that for someone living and working in a single country, dodging taxes is way more…

-

The Cost of Tax Incentives in Uganda

The government in Uganda still generously grants tax incentives, even though studies show these rarely affect a company’s decision when looking for investment opportunities. Even so the government still believes that such incentives attract investments, create jobs and boost trade and therefore will continue offering tax holidays in addition to free land as and when investors…

-

Illicit Financial Flows and Gender Justice

The current legal and political frameworks that allow multinational corporations to benefit from tax abuse to the detriment of people and planet and the disproportional gender impact of these illicit financial flows (IFFs). That is the subject of the policy brief published by AWID (Association for Women’s Rights in Development). AWID is an international feminist…

-

Dutch Employers Organization Worried About New Tax Avoidance Bill

A new tax avoidance bill proposed by the Dutch demissionary cabinet threatens to make the Netherlands less attractive for international corporations. At least that’s what employers organization VNO-NCW and the Dutch Order of Tax advisers (Nederlandse Orde van Belastingadviseurs) claim in a recent internet consultation. They criticize the way the cabinet is planning to convert…

-

UN: Tax Competition and Tax Avoidance “Inconsistent” With Human Rights

There is evidence that human rights protection bodies increasingly recognize the link between tax competition and corporate tax avoidance and human rights violations. This is the conclusion when reading the analysis of Niko Lusiani, Director of the Human Rights in Economic Policy of the Center for Economic and Social Rights (CESR), following the recent release of the UN…

-

New EU Directive To Tackle Multinationals’ Tax Dodging

The European Parliament just made a significant first step in the fight against tax dodging by large multinationals, by passing a directive which would require them to report tax and financial data separately in all countries where they operate. Currently they disclose their operations in one consolidated report, which makes it impossible to track where…

-

Only One Country Fails OECD Transparency Standards?!

According to the OECD, Trinidad and Tobago is the only country that fails to comply with international tax transparency standards, something Oxfam strongly disputes. Even though the US and the Bahamas only made extremely weak commitments and many other countries, like those featured on Oxfam’s list of worst corporate tax havens, still accommodate tax dodging…

-

End the Era of Tax Havens

End the era of tax havens: fair taxation to fund health and education Guest blog by Johan Langerock, policy advisor for fair tax at Oxfam Novib The Organization for Economic Cooperation and Development (OECD) is organizing a large plenary meeting on 21-22 June in the Netherlands to discuss international taxation with more than 100 countries.…

-

CSO’s: Uganda Should Stop Offering Tax Incentives

CSO’s have requested the Ugandan government to perform a cost-benefit analysis to determine whether tax incentives are actually cost efficient. These incentives are meant to attract investors, but they are also prone to abuse. This year, the Ugandan government spent Shs 77 billion (approximately $21.5 million) to pay taxes for Bidco Oil Refineries Ltd, Aya…

-

#TaxJustice for #PublicServices Global Week of Action

This June the Global Alliance for Tax Justice, Public Services International, ITUC-Africa, ActionAid, Oxfam, Global Campaign for Education and several other partners will organize the #TaxJustice for #PublicServices Global Week of Action, culminating in World Public Service Day, which was established by the UN in 2003. During this week trade unions, civil society organizations and NGOs will organize…

-

De Correspondent Reveals How The Netherlands Became Tax Haven

Tax dodging by multinationals perpetuates poverty as it robs countries of the necessary resources to invest in pro-poor policies. There are many ways to dodge tax, but tax havens in particular play a facilitating role in denying countries their fair share of taxes. Below we will share with you some revelations from todays article from the…

-

The Inadequate Vietnamese Tax Incentive System

The Vietnamese tax system still leaves much to be desired. It’s not very effective in preventing tax dodging by companies and its incentives are very generous at the expense of the state budget. That is the assessment Oxfam made recently at an event titled “Tax equality: a view from the operation of multinational companies and banks.” This event…

-

Launch of Nigeria Inequality Report

On Wednesday May 17th Oxfam International launched the Nigeria Inequality Report, which caused quite a stir in the national media. Nigeria is seen as Africa’s largest economy and one of the fastest-growing in the world. Yet, more than half of the Nigerian population still grapples with extreme poverty, while a small elite enjoys ever-growing wealth.…

-

Exciting Times for International Tax Policy

Recently Oxfam Novib’s own tax expert Francis Weyzig was in Luxembourg for a conference and a radio interview on tax evasion. Whereas people who have been fighting for debt relief have waited decades for any significant progress, things are actually moving quite fast in the battle against tax evasion. As a result of major scandals like the Panama…

-

Houseplant Excursions

Always wanted to know how to evade tax? Just book an excursion with Kamerplant Tours, Dutch for Houseplant Excursions, in Amsterdam and they’ll teach you all you need to know. Actually, this is an art project by artist Tinkebell and financial journalist Arno Wellens to illustrate the absurdity of the Dutch tax system. By now…

-

Race to the Bottom – Tax Incentives in South East Asia

In order to attract foreign investments, developing countries have been fiercely competing these past years and have been offering more and more advantages to investors; among them, tax incentives. Nonetheless, this tool proves to be effective only when real competition occurs between countries, when investors do have a choice between two different locations, which happens…

-

Ecuador’s Minister for FA Adresses Human Rights Council

At the Human Rights Council in Geneva (March 2017) the Ecuadorean Foreign Affairs Minister Guillaume Long proposed a plan to “advance together in a global agenda for fiscal justice”. A plan first introduced at the 71st Un General Assembly last year. He once again underscored how tax dodging by the elite profoundly affects the economy of the majority of the…

-

Report on Tax Transparencies and Extractive Industries

In 2016, for the first time, EU registered/listed extractive companies reported their payments to governments in countries where they have extractive activities (including their taxes), country by country and project by project. One of the main objectives of the directive setting these obligations is to raise awareness about the activities of extractive companies in resource-rich…

-

The Second National Tax Justice Youth Film Festival Pakistan

Oxfam and its partners Indus Consortium and Rise for Equality celebrated National Tax Justice Youth Film Festival at PMAS Arid Agriculture University. This second National Tax Justice Youth Film Festival focused on creating awareness regarding fiscal justice in Pakistan with the active participation of our youth. With the theme of “ Fair Taxation – Gender…

-

Oxfam and Partners Strategy Meeting in Lagos

Oxfam, CISLAC, Action Aid Nigeria, BudgIT, NDEBUMOG and KEBETKACHE came together in Lagos, Nigeria to sharpen their strategies on government and private sector engagement. During this three-day meeting, which lasted from March 21st until March 23rd, the specific focus areas were tax policies and budget policies, both on the Federal and State level, and private sector…

-

FTM Uganda 2016

The FTM allows for a comparison of tax policies and practices in different countries, using a standardized methodology and unified research approach thanks to jointly developed common research framework. In the Uganda FTM report you can find the detailed research results from Uganda.

-

An Economy That Works For Women

Achieving women’s economic empowerment in an increasingly unequal world Women’s economic empowerment could reduce poverty for everyone. In order to achieve it however, we need to first fix the current broken economic model which is undermining gender equality and causing extreme economic inequality. The neoliberal model has made it harder for women to have higher…

-

FTM Senegal 2016

The FTM allows for a comparison of tax policies and practices in different countries, using a standardized methodology and unified research approach thanks to jointly developed common research framework. In the Senegal FTM report you can find the detailed research results from Senegal. This report is in French.

-

CRAFT Project’s Stories of Change in Mali

In order to identify and understand some of the changes that took place after the intervention of the CRAFT Project, the Malian coalition Publiez Ce Que Vous Payez (PCQVP) collected 12 Stories of Change in December 2015. These stories have been analyzed and collected in this report. It particularly focuses on changes in the understanding…

-

Davos Inequality Action Week in Pakistan

As the world’s political and business leaders were gathered in Davos for the Annual Meeting of the World Economic Forum, Oxfam in Pakistan organised the Davos Inequality Action Week. From January 16th-30th they organised all sorts of events to raise awareness about the ever increasing inequality. Among these events were the launch of a summary of…

-

Joint TJN-A and Oxfam Factsheet on Tax and Inequality

In light of the Global #FightInequality week (14-20 January 2017), TJN-A and Oxfam have circulated a factsheet on Tax and Inequality. It contains concise background information on the link between tax and inequality and has an overview of the key terms and concepts. The Factsheet can be found here: Download

-

Fighting Inequality Around the World

Guest blog by Stefan Verwer. Eight men own the same wealth as the 3.6 billion people who make up the poorest half of humanity. You probably have noticed: this week Oxfam highlighted the fact that the gap between rich and poor is far greater than we have ever feared. Our fight against inequality plays a…

-

Press Statement Ugandan CSO’s: MP’s Should Pay Tax

November 20th 2016 like-minded Ugandan CSO’s held a press conference at the SEATINI offices, asking the Ugandan president to stand his ground and keep insisting that members of parliament (MP’s) should pay taxes over their allowances. How can you justify a country’s elected officials exempting themselves from paying taxes, especially in a country that already has…

-

Debate: Welcome to Tax Haven Netherlands

Both rich and poor countries miss out on billions of dollars a year because of tax evasion. Big corporations make use of profitable tax rules set up by national governments. How do these negotiations proceed? And what about the oversight? We’d like to invite you to discuss this during our debate “Welcome to Tax Haven…

-

Oxfam Policy Paper: Tax Battles

Today Oxfam launched Tax Battles, a scathing report that details how unfair corporate tax laws are fueling a race to the bottom, which is costing developing countries billions of dollars in tax revenue and is increasing poverty and inequality worldwide. It also contains a list of the fifteen countries that are considered the world’s worst…

-

Video: Ireland’s Most Expensive Pint?

October 12th was Budget Day in Ireland. On this day the government presents next year’s budget plans. Last week, in anticipation of this day, Oxfam Ireland released the video below. It’s a funny yet provocative hidden camera video, situated in a Dublin pub, which highlights their MakeTaxFair campaign. How would you react if you had to…

-

Increased pressure for Global Tax Body

At the 71st UN General Assembly Guillaume Long, Ecuador’s Minister for Foreign Affairs and Human Mobility, proposed the creation of a global tax body. This proposed UN body would consist of member states and concern itself with international tax issues, like clamping down on tax evading multinationals, shutting down tax havens and exposing the corrupt elite…

-

International Tax Justice Blogging Day 2016

September 7th 2016 was International Tax Justice Blogging Day. On this day we campaigned to encourage people to become more aware of the effects of tax evasion. Tax campaigner activists, supported by over 20 organisations across Europe and the Global South as part of the EU project Tax Justice Together, wrote blogs to outline why they are campaigning in support of…

-

He Who Runs Away…

He who runs away from the fight for Tax justice, lives to fight it another day. Guest blog by Webster Sinkala – Tax Justice Activist, Activista, Action Aid Zambia, written for International Tax Justice Blogging Day 2016 It is now common sense in Southern Africa that when you graduate, you have to be on the…

-

Similar Design, New Features

Guest blog by Esmé Berkhout, written for International Tax Justice Blogging Day 2016 On the 7th of September Apple’s CEO Tim Cook is expected to hold his famous keynote. People around the globe will be curious to hear about the new iPhone7. With similar design as iPhone 6, but of course with some new features. My…

-

An Interesting Move From The Dutch Government

Guest blog by Andrea Brouwer, published to mark International Tax Justice Blogging Day 2016 Eric Wiebes of the Ministry of Finance has written a letter to multinationals who wish to settle in the Netherlands. He warns them not to have high expectations of generous tax benefits. “Please take sober state support into account.” Wiebes wrote…

-

Do We Pay Our Equivalent Share?

Guest blog by Habtegiorgis Eyob, published to mark International Tax Justice Blogging Day 2016 Are you familiar with tax evasion, tax avoidance, tax havens, tax scam, tax dodging and mailbox companies? These are the frequent words I have heard in the Even it Up team at Oxfam Novib in the last two months. I believe many…

-

Putting tax into perspective

A necessary ingredient for a healthier society. Literally. Guest blog by Jan-Willem Pot, published to mark International Tax Justice Blogging Day 2016 Before the Ebola outbreak happened, the three worst affected countries, Guinea, Sierra Leone and Liberia, had an average of one hospital bed per 2128 people. Sierra Leone had 136 doctors on a population…

-

Tax Competition: Debunk the Myth

How big is the real problem of tax competition? Guest blog by Chanh-Nghi Lam Foreign Direct Investments: these are at the top of the wish-list of developing countries and something they have been fighting over for years. Indeed, in order to fill the gap between the North and the South, developing countries have relied…

-

FTM Bangladesh 2016

The FTM allows for a comparison of tax policies and practices in different countries, using a standardized methodology and unified research approach thanks to jointly developed common research framework. In the Bangladesh FTM report you can find the detailed research results from Bangladesh.

-

Informative animation on indirect tax in Pakistan

The Tax Justice Coalition Pakistan recently published the following video animation detailing how poor and middle income households in that country carry 75 percent of the tax contribution, and outlining measures required to restore a degree of progressivity to what is an increasingly unjust tax regime. It clearly illustrates why too much indirect tax unduly burdens the…

-

Ending the Era of Tax Havens

26% of increased wealth went to the richest 1% in the UK over 2000-2015 UK’s wealthiest are hiding over £170bn offshore The City of London Corporation, a lobbyist for the UK financial services sector, has privileges and ‘freedoms’ which in some ways put it outside of normal UK civic governance PwC, one of the ‘Big Four’ auditing…

-

CRAFT Progress Report 2013 – 2015

The Capacity for Research and Advocacy for Fair Taxation (CRAFT) project was developed through collaboration between Oxfam Novib, Tax Justice Network – Africa and other country based partners in Uganda, Mali, Senegal, Nigeria, Ghana, Egypt and Bangladesh with a view to achieve accountable, fair and pro – poor tax systems. CRAFT Narrative Report April 2013-…

-

Rap about Tax Injustice in Senegal

For the past several years Xuman and Keyti have been rapping the Senegalese news in their ‘Journal Rappé’, thus making it more accessible for a wider, mostly younger, audience. Seeing as Senegal’s population has a median age of just over 18 years old this seems to be a good strategy. One of their latest items…

-

Successful National Tax Justice Youth Film Festival in Pakistan

The National Tax Justice Youth Film Festival in Pakistan, which Oxfam Pakistan and partners organized in December 2015, was a huge success. At this festival several movies about human rights and taxes were shown to provide information and create awareness among the people of Pakistan about the importance of fair taxation to achieve sustainable growth. The main…

-

CRAFT partner organized lobby meetings in Bangladesh

Campaign for Good Governance (CGG/SUPRO), a partner of the CRAFT program, organized several lobby meetings with tax officers throughout Bangladesh.

-

Fair Tax Monitor country reports launched

The Fair Tax Monitor (FTM) is a unique evidence-based advocacy tool that identifies the main bottlenecks within tax systems and provides strong evidence for advocacy work at national and international level.

-

Launch of the Fair Tax Monitor in Dakar, Senegal

Oxfam and its partner le Forum Civil presented the first report of the Fair Tax Monitor (FTM) in Dakar last Friday.

-

CRAFT Pakistan Policy Briefs and Publications

Below you can find the most recent policy briefs and publications of our CRAFT Pakistan team. The publication “Equity in Tax Laws” explains how the tax burden in Pakistan is placed mostly on the shoulders of the poor while the rich profit, and what should be done to fix this unjust tax system. Download it here: Equity…

-

8th CRAFT Strategy Meeting, Dhaka, Bangladesh March 2015

The 8th Craft Strategy Meeting in Dhaka, Bangladesh took place in March. Again it was a valuable and constructive meeting with representatives of all involved organizations attending. Thanks to everybody for their input and effort. The progress of the CRAFT project is the result of a combined commitment to our objectives. This video gives an impression of the…

-

Key Fair Tax Issues from Countries Baseline Studies

Each CRAFT country conducted a baseline study regarding specific tax related themes. This report provides an overview of the key tax issues that came out of these baseline studies, clustered around the main thematic topics. In addition there is a short country by country summary of the main findings. Download pdf

-

SUPRO and Oxfam about pro-poor tax system in Bangladesh

SUPRO and Oxfam share recommendations for pro-poor tax system with Bangladesh MPs In January this year the Bangladesh Parliamentary Caucus on National Planning and Budgeting hosted a lobby meeting on the 7th Five Year Plan and budget for fiscal year 2015-16. During the meeting, Oxfam and its campaigning partner SUPRO had the opportunity to share…

-

The 8th CRAFT Strategy Meeting Bangladesh 2015

The 8th CRAFT Strategy Meeting Bangladesh 2015 The 8th CRAFT Strategy Meeting will be held in Dhaka, Bangladesh from 10 to 12 March 2015. The first day will be a conference where our CRAFT Participants from 11 countries will be joined by Bangladesh Government Representatives, representatives of diplomatic missions and (Inter)national NGOs. There will be panel…

-

CRAFT Overall Progress

Stop unfair taxation as soon as possible. Inform yourself and contact the lead partner in your country to get involved. Fair taxation can truly make a significant change! CRAFT Overall Progress Here you find an overview of the most recent CRAFT reports. Combined they offer insight in the developments, achievements and challenges of the CRAFT project so far. It…

-

Examples and pictures of CRAFT activities 2014

Examples and pictures of CRAFT activities 2014 This document shows some CRAFT activities that have been organized in several participating countries. Nice to see how CRAFT initiatives are being carried out. Much appreciation for all the hard work people put into it! Download pdf

-

Joint Oxfam International Inequality Campaign & CRAFT Sixth Strategy Meeting held 4th to 8th February 2014

In February 2014 a Joint Oxfam International Inequality Campaign & CRAFT Strategy Meeting was organized in Accra, Ghana, in the framework of the CRAFT project. In combination with the Progress Report 2012-2013 and the report about the 7th Stakeholder Meeting in June 2014, this report offers a comprehensive overview of the progress of the CRAFT project so…

-

CRAFT Framework 2015 – 2018

This document outlines the overall program framework for the April 2015 – March 2018 period. CRAFT increasingly provides a platform for dialogue between a variety of stakeholders – including Revenue Authorities, Ministries of Finance and Members of Parliament – realizing they have a common interest: raising and using taxes in their country in a fair…

-

CRAFT Mali Baseline Study 2013

CRAFT Mali Baseline Study 2013 In collaboration with OXFAM, PCQVP (Publiez Ce Que Vous Payez) has commissioned the baseline study on the tax system in Mali. Download pdf This report provides you with information about: Social justice and the situation of the poor in Mali Development of public revenues and the features of the tax structure in Mali the…

-

CRAFT Senegal Baseline Study 2013

In collaboration with OXFAM, FORUM CIVIL has commissioned the baseline study on the tax system in Senegal. Download pdf This report provides you with information about: Social justice and the situation of the poor in Senegal Development of public revenues and the features of the Senegalese tax structure the way forward to a more just tax system in Senegal the…

-

CRAFT Egypt Baseline Study 2013

In collaboration with OXFAM, ECESR has commissioned the baseline study on the tax system in Egypt. Download pdf This report provides you with information about: Social justice and the situation of the poor in Egypt Development of public revenues and the features of the Egyptian tax structure the way forward to a more just tax system…

-

CRAFT Nigeria Baseline Study 2013

In collaboration with OXFAM, CISLAC has commissioned the baseline study on the tax system in Nigeria. Download pdf This report provides you with information about: An overview of the history of the Nigerian tax system the Nigerian tax system results of data analysis findings on the Tax Gaps concluding remarks and recommendations

-

CRAFT Uganda Baseline Study 2013

In collaboration with OXFAM, SEATINI has commissioned the baseline study on the tax system in Uganda. Download pdf This report provides you with information about: Uganda and history of taxation the Ugandan tax system the administrative capacity in tax collection taxation and the good governance agenda conclusions and recommendations

-

CRAFT Bangladesh Baseline Study 2013

In collaboration with OXFAM, SUPRO has commissioned the baseline study on the tax system in Bangladesh. English report: Download pdf Bangla report: Download pdf This report provides you with information about: the historical overview of the Tax system of Bangladesh present scenarios of Tax structure and Tax system in Bangladesh Tax Gap analysis in Bangladesh findings…

-

CRAFT Ghana Baseline Study 2013

In collaboration with OXFAM America and with funding from the German International Development (GIZ), the Ghana Integrity Initiative (GII) has commissioned the baseline study of Ghana’s tax system. Download pdf This report provides you with information about: the historical background to taxation in Ghana the distribution of the tax burden in Ghana the taxation challenges…

-

Oxfam launches Even It Up! campaign

Time to end extreme inequality “This report from Oxfam is a stark and timely portrait of the growing inequality which characterises much of Africa and the world today… It contains many examples of success to give us inspiration. I hope that many people from government officials, business and civil society leaders, and bilateral and multilateral…

-

7th Meeting of CRAFT Stakeholders (June, 2014)

Last June the 7th Meeting of CRAFT Stakeholders took place in Nayvasha Kenia. The meeting was a two-day event that was divided into two sessions. The first day was a closed-door session for internal stakeholders and held focused discussions on practical project implementation. Representatives of all the stakeholders participated. A special welcome to the representatives…

-

Regional integrated tax systems needed to curb illicit financial flows

The journalist Patrick Jaramogi covered a joint session of the 7th CRAFT Stakeholder Meeting and ITUC/ TJN-A Tax and Extractives Industries Training that have been held at Lake Naivasha Panorama Park Hotel from 25th-28th June, 2014 in Naivasha, Kenya. African states have the capacity to fully finance their budgets, if they can tame the…

-

CRAFT-PROGRESS-REPORT-2012-2013

The Capacity for Research and Advocacy for Fair Taxation (CRAFT) project was developed through collaboration between Oxfam Novib, Tax Justice Network – Africa and other country based partners in Uganda, Mali, Senegal, Nigeria, Ghana, Egypt and Bangladesh with a view to achieve accountable, fair and pro – poor tax systems. Download PDF

-

The Tax Free Tour – VPRO Backlight

You are here: HomeEnglishThe Tax Free TourThe Tax Free Tour 25.03.2013 Zoom”Where do multinationals pay taxes and how much?” Gaining insight from international tax experts, Backlight director Marije Meerman (‘Quants’ & ‘Money & Speed’), takes a look at tax havens, the people who live there and the routes along which tax is avoided globally.

-

5th CRAFT strategy meeting Tunis

For the 5th time CRAFT partners join hands to link and learn from each other. The consortium consists of Tax Justice Network-Africa, SEATINI Uganda, SUPRO Bangladesh, PCQVP Mali, ECESR Egypt, CISLAC Nigeria, Forum Civil Senegal, the Ghana Integrity Initiative and Oxfam Novib.

-

Leuker kunnen we het niet maken! Tax Justice?

Multinationale ondernemingen gebruiken Nederlandse postbusfirma’s om zo min mogelijk belasting te betalen. Alvin Mosioma is directeur van het Tax Justice Network Africa. Hij zal uiteenzetten hoe er vanuit Afrikaanse landen tegen deze vorm van het ontlopen van belasting wordt aangekeken.