Category: Blog / News

-

Fair Tax Monitor delivers training on tax & gender for civil society organizations in Senegal

This blog can also be accessed in French here. Group photo of participants at the training for civil society organizations involved in the Gender Equality in Taxation GET project As part of the ongoing partnership between the Fair Tax Monitor (FTM) and Expertise France through the Gender Equality in Taxation (GET) project, a training event…

-

FTM Partners with Expertise France to Tackle Gender Inequality Through Tax Justice

By Henrique Alencar, Policy Advisor Tax and Inequality at Oxfam and Andrea Salazar Cardero, Intern with Oxfam Novib This article can also be accessed in French here. Building on a decade of dedicated efforts to highlight gender disparities in fiscal systems, the Fair Tax Monitor (FTM) has partnered with Expertise France. Specifically, this partnership seeks to…

-

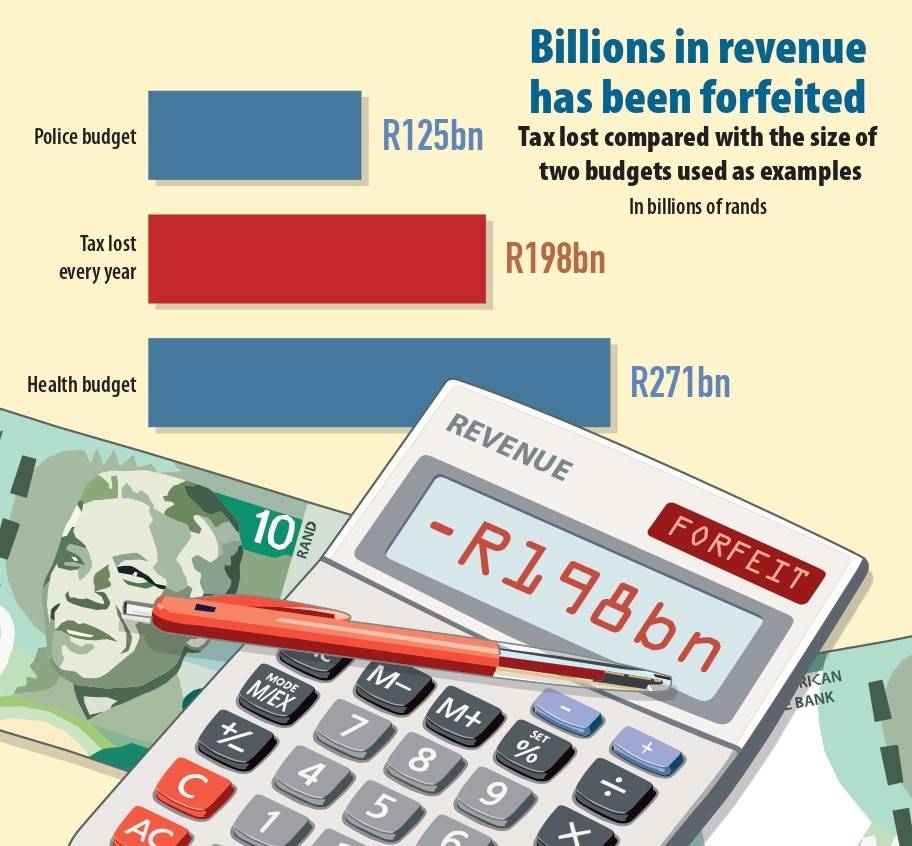

A preview of the South Africa FTM: How the Treasury is forfeiting R198bn a year due to tax bracket over-inflation

By Chloé van Biljon Oxfam Novib and Tax Justice Network-Africa are currently working with the Alternative Information & Development Centre (AIDC) on a South Africa FTM report. The following analysis on the Personal Income Tax brackets of the South African tax system is a result of the research being carried out in preparation of the…

-

The World Economic Forum 2025: Time to Tax the Richest and End Extreme Wealth

January 20th marked the beginning of the 2025 World Economic Forum’s annual meeting in Davos. The event brings together global leaders in politics and business to discuss key global and regional challenges – such as responding to geopolitical shocks and stimulating economic growth – with little transparency or representation from regular citizens and other stakeholders.…

-

What is Nigeria’s path to closing the revenue gap for development?

Following the recent publication of the Fair Tax Monitor Nigeria Report: Taxing the Rich, FTM’s Ishmael Zulu was interviewed for the Business Edge on Nigeria’s national station News Central. In this wide-ranging and comprehensive interview, a number of topics were addressed, such as Nigeria’s critical revenue gap, which threatens its development goals and the stark…

-

New Fair Tax Monitor Nigeria Report: Taxing the Rich to Combat Inequality

On 15th October 2024, the newest Fair Tax Monitor (FTM) report, thematically focused on Taxing the Rich, was launched in Nigeria. It shines a light on a critical issue: how fair taxation of the wealthiest could be the key to tackling the country’s deepening hunger and inequality crisis.

-

FTM countries vote in favour of the Terms of Reference for the UN Tax Convention

Image of the final vote results on the TOR for the UN Tax Convention Gaining UN approval for negotiating a legally binding agreement is usually a journey, and often quite a tricky and tiresome one. On 16th August, one such expedition reached a momentous destination however as, in a historic win for tax justice, UN…

-

Constantly responding, consistently evolving: Explanation of the FTM thematic approach

The Fair Tax Monitor was initially developed in 2015 by Oxfam and Tax Justice Network Africa (TJNA) in collaboration with partners from four pilot countries Uganda, Senegal, Pakistan and Bangladesh. Since then, we’ve consistently incorporated lessons learned to further refine the methodology. In 2019, we had our first review addressing the fact that since the…

-

Gender-Disaggregated Tax Data in Addressing Inequality: A Zambian Success Story

This blog was written by Ishmael Zulu, Policy Officer of Tax and Equity at Tax Justice Network Africa Comprehensive and nuanced data are essential for understanding and tackling gender inequality. An often-overlooked aspect is gender-disaggregated tax data, which can provide valuable insights into the differential impact of tax systems on men and women. This data is crucial…

-

Oxfam and TJNA Collaborate with AIDC to Explore Fair Tax Monitor Report for South Africa

In a week-long engagement at the Cape Town offices of the Alternative Information and Development Centre (AIDC), representatives from Oxfam and Tax Justice Network Africa (TJNA) visited the Alternative Information and Development Centre (AIDC). The visit marked a collaborative effort to discuss the feasibility of producing a Fair Tax Monitor report tailored to South Africa,…

-

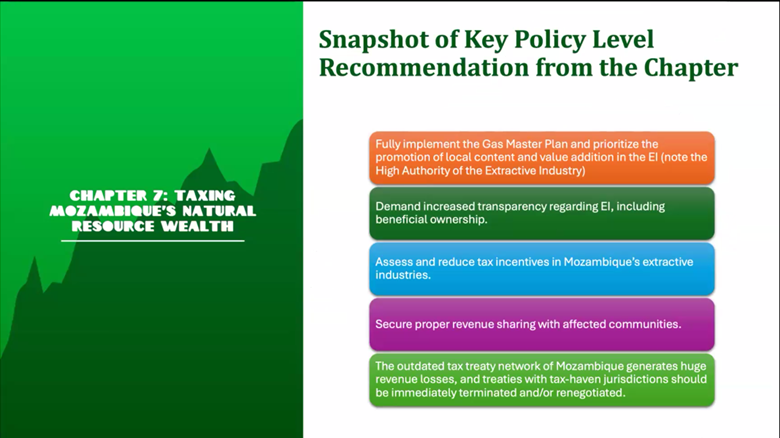

FTM hosts Tax and Extractives webinar

On April 9th 2024, the FTM team organized a session during which our partner, the Centre for Democracy and Human Rights (CDD), in Mozambique presented their experience of using the new Fair Tax Monitor (FTM) chapter on Extractives. The session was kicked-off by Adelson Rafael, a colleague from Oxfam Mozambique, who introduced the research and…

-

Inclusive Tax Cooperation at the UN and the Stance of the Netherlands

This blog was written by Henrique Alencar, Policy Advisor Tax and Inequality at Oxfam At the 2022 United Nations General Assembly, several resolutions were discussed that have a major impact on global issues. One of those resolutions could change the way international tax rules are created and promote a new system that addresses tax avoidance…

-

FTM hosts workshop at the Fair4ALL event in Accra, Ghana

Photo credit: Facebook page of Oxfam Ghana In February 2024 the Fair4All programme – a largescale influencing program on the theme of fair value chains – held a regional learning event in Accra, Ghana, in which the Fair Tax Monitor took part. More than twelve countries involved in the Fair4All programme came together to share,…

-

Fair Tax Monitor 2019 – Revised

The Fair Tax Monitor is a tool that was jointly developed by Oxfam and the Tax Justice Network Africa (TJNA) in order to assess the progressiveness, transparency and accountability of various national tax systems around the world. Working with a methodology that gives a score to countries based on the criteria mentioned above, it has…

-

Taxes, Taxes, Taxes… Their importance explained

Even though it is a while ago, the appearance of Rutger Bregman at the World Economic Forum meeting in Davos is still relevant. He addressed the issue of tax avoidance by big multinationals at the meeting where the richest CEOs, politicians and intellectuals gather yearly to talk about…well, anything but taxes. Why are taxes so…

-

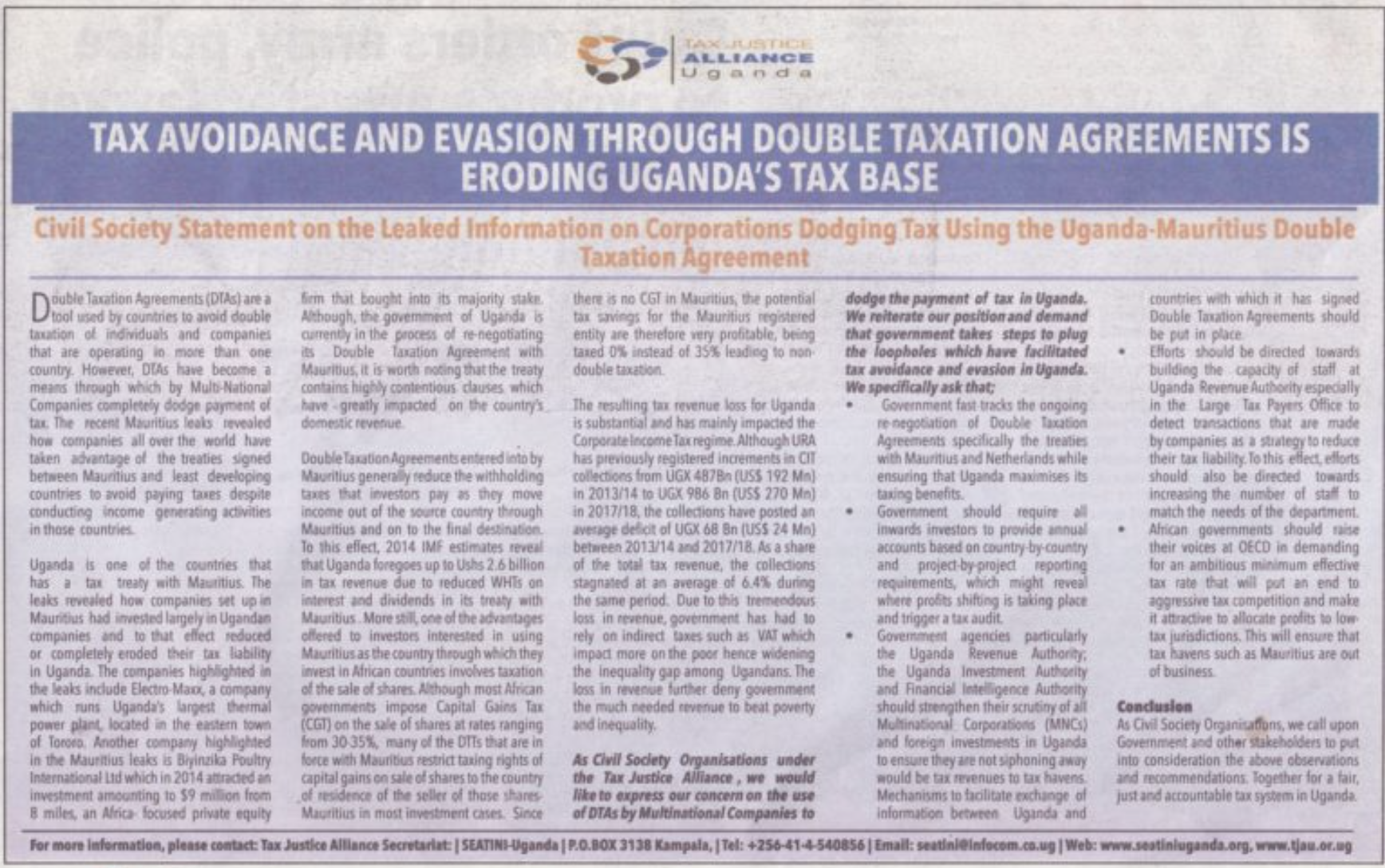

Tax avoidance and evasion through double taxation agreements is eroding Uganda’s tax base

A Civil Society statement, released by the Tax Justice Alliance and SEATINI-Uganda, expresses concern regarding corporations dodging tax using the Uganda-Mauritius Double Taxation Agreement. Double Taxation Agreements (DTA) are a tool used by countries to avoid double taxation of individuals and companies operating in more than one country. However, DTAs have become a way for multinational…

-

Launch of the Fair Tax Monitor and the Commitment to Reducing Inequality Index report in Nigeria

Today, Oxfam in Nigeria joins the rest of the world to mark the World Day of International Justice with the launch of the Fair Tax Monitor report as well as the Commitment to Reducing Inequality Index (CRII) report in Abuja, Nigeria. The Fair Tax Monitor (FTM) is a research and advocacy tool developed jointly by…

-

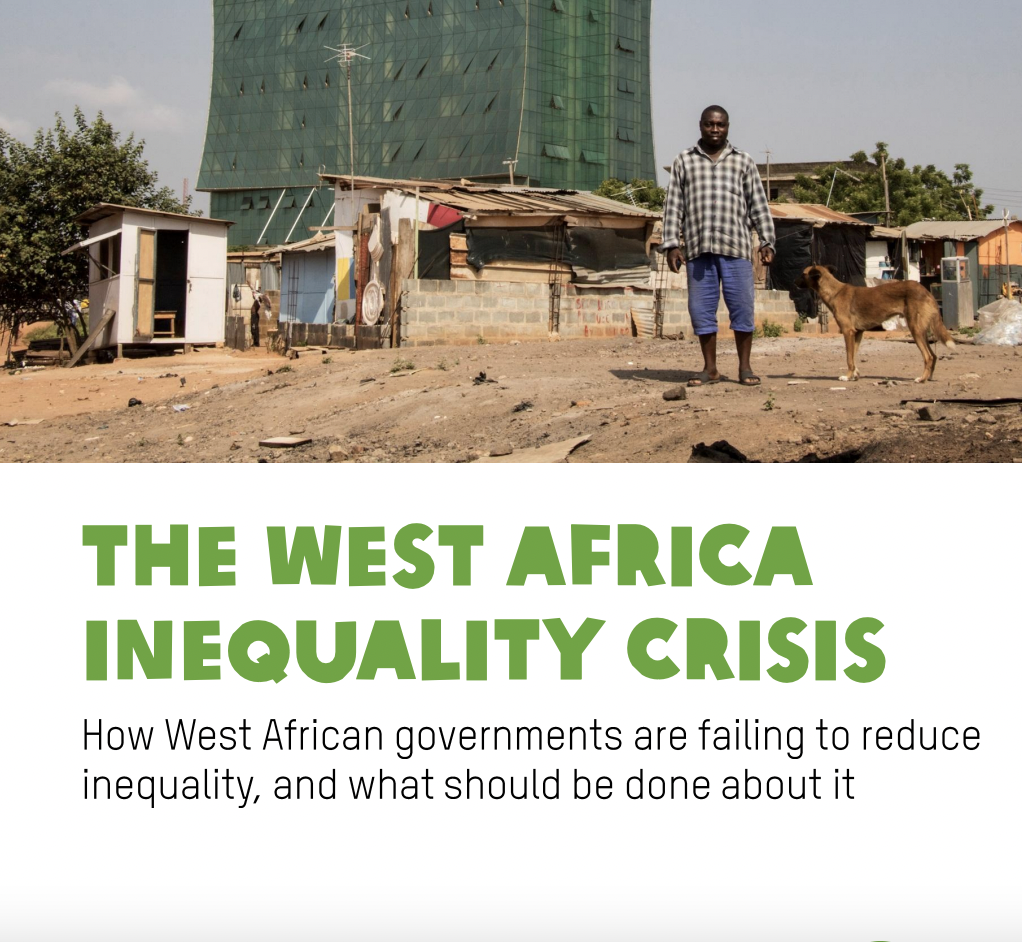

Launch of the WAF Commitment to Reducing Inequality Report (CRII)

West African Governments are the least committed to reduce inequalities in Africa Oxfam and Development Finance International have launched the first ever Commitment to Reducing Inequality Index (CRII) regional report. The index measures, compares and ranks West African governments’ commitment on 3 pillars: public spending, taxation, and labour markets. The report also includes a regional analysis…

-

Beans and Ugali for Ugandan Politicians

Launch Fair Tax Monitor in Uganda big success Millions of Ugandans now know that the tax system in Uganda is not fair. The launch of the Fair Tax Monitor by Oxfam and partner SEATINI at the end of January was on the biggest national private television in Uganda (NTV), the radio and debated in many…

-

Launch of the Fair Tax Monitor in Uganda

Oxfam and SEATINI Uganda are launching a study entitled Fair Tax Monitor Study: Uganda.

-

The World Bank’s Incoherent Approach to Taxes

The World Bank should revise its Doing Business report…

-

Global Alliance for Tax Justice – Highlights of 2017

Both Oxfam Novib and Tax Justice Network – Africa are very proud to be part of…

-

Tax Incentives and the African Education Finance Gap

How much revenue do African governments lose from providing tax incentives…

-

Bermuda: We Are Not a Tax Haven

Guest blog by Francis Weyzig, senior policy advisor for fair tax at Oxfam Novib In a highly entertaining Dutch TV documentary, small entrepreneur Jan sets out to minimize his tax bill. That’s easier said then done! Jan quickly finds out that for someone living and working in a single country, dodging taxes is way more…

-

UN: Tax Competition and Tax Avoidance “Inconsistent” With Human Rights

There is evidence that human rights protection bodies increasingly recognize the link between tax competition and corporate tax avoidance and human rights violations. This is the conclusion when reading the analysis of Niko Lusiani, Director of the Human Rights in Economic Policy of the Center for Economic and Social Rights (CESR), following the recent release of the UN…

-

New EU Directive To Tackle Multinationals’ Tax Dodging

The European Parliament just made a significant first step in the fight against tax dodging by large multinationals, by passing a directive which would require them to report tax and financial data separately in all countries where they operate. Currently they disclose their operations in one consolidated report, which makes it impossible to track where…

-

Only One Country Fails OECD Transparency Standards?!

According to the OECD, Trinidad and Tobago is the only country that fails to comply with international tax transparency standards, something Oxfam strongly disputes. Even though the US and the Bahamas only made extremely weak commitments and many other countries, like those featured on Oxfam’s list of worst corporate tax havens, still accommodate tax dodging…

-

End the Era of Tax Havens

End the era of tax havens: fair taxation to fund health and education Guest blog by Johan Langerock, policy advisor for fair tax at Oxfam Novib The Organization for Economic Cooperation and Development (OECD) is organizing a large plenary meeting on 21-22 June in the Netherlands to discuss international taxation with more than 100 countries.…

-

De Correspondent Reveals How The Netherlands Became Tax Haven

Tax dodging by multinationals perpetuates poverty as it robs countries of the necessary resources to invest in pro-poor policies. There are many ways to dodge tax, but tax havens in particular play a facilitating role in denying countries their fair share of taxes. Below we will share with you some revelations from todays article from the…

-

The Inadequate Vietnamese Tax Incentive System

The Vietnamese tax system still leaves much to be desired. It’s not very effective in preventing tax dodging by companies and its incentives are very generous at the expense of the state budget. That is the assessment Oxfam made recently at an event titled “Tax equality: a view from the operation of multinational companies and banks.” This event…

-

Joint TJN-A and Oxfam Factsheet on Tax and Inequality

In light of the Global #FightInequality week (14-20 January 2017), TJN-A and Oxfam have circulated a factsheet on Tax and Inequality. It contains concise background information on the link between tax and inequality and has an overview of the key terms and concepts. The Factsheet can be found here: Download

-

Fighting Inequality Around the World

Guest blog by Stefan Verwer. Eight men own the same wealth as the 3.6 billion people who make up the poorest half of humanity. You probably have noticed: this week Oxfam highlighted the fact that the gap between rich and poor is far greater than we have ever feared. Our fight against inequality plays a…

-

Press Statement Ugandan CSO’s: MP’s Should Pay Tax

November 20th 2016 like-minded Ugandan CSO’s held a press conference at the SEATINI offices, asking the Ugandan president to stand his ground and keep insisting that members of parliament (MP’s) should pay taxes over their allowances. How can you justify a country’s elected officials exempting themselves from paying taxes, especially in a country that already has…

-

Oxfam Policy Paper: Tax Battles

Today Oxfam launched Tax Battles, a scathing report that details how unfair corporate tax laws are fueling a race to the bottom, which is costing developing countries billions of dollars in tax revenue and is increasing poverty and inequality worldwide. It also contains a list of the fifteen countries that are considered the world’s worst…

-

International Tax Justice Blogging Day 2016

September 7th 2016 was International Tax Justice Blogging Day. On this day we campaigned to encourage people to become more aware of the effects of tax evasion. Tax campaigner activists, supported by over 20 organisations across Europe and the Global South as part of the EU project Tax Justice Together, wrote blogs to outline why they are campaigning in support of…

-

He Who Runs Away…

He who runs away from the fight for Tax justice, lives to fight it another day. Guest blog by Webster Sinkala – Tax Justice Activist, Activista, Action Aid Zambia, written for International Tax Justice Blogging Day 2016 It is now common sense in Southern Africa that when you graduate, you have to be on the…

-

Similar Design, New Features

Guest blog by Esmé Berkhout, written for International Tax Justice Blogging Day 2016 On the 7th of September Apple’s CEO Tim Cook is expected to hold his famous keynote. People around the globe will be curious to hear about the new iPhone7. With similar design as iPhone 6, but of course with some new features. My…

-

An Interesting Move From The Dutch Government

Guest blog by Andrea Brouwer, published to mark International Tax Justice Blogging Day 2016 Eric Wiebes of the Ministry of Finance has written a letter to multinationals who wish to settle in the Netherlands. He warns them not to have high expectations of generous tax benefits. “Please take sober state support into account.” Wiebes wrote…

-

Do We Pay Our Equivalent Share?

Guest blog by Habtegiorgis Eyob, published to mark International Tax Justice Blogging Day 2016 Are you familiar with tax evasion, tax avoidance, tax havens, tax scam, tax dodging and mailbox companies? These are the frequent words I have heard in the Even it Up team at Oxfam Novib in the last two months. I believe many…

-

Putting tax into perspective

A necessary ingredient for a healthier society. Literally. Guest blog by Jan-Willem Pot, published to mark International Tax Justice Blogging Day 2016 Before the Ebola outbreak happened, the three worst affected countries, Guinea, Sierra Leone and Liberia, had an average of one hospital bed per 2128 people. Sierra Leone had 136 doctors on a population…

-

Tax Competition: Debunk the Myth

How big is the real problem of tax competition? Guest blog by Chanh-Nghi Lam Foreign Direct Investments: these are at the top of the wish-list of developing countries and something they have been fighting over for years. Indeed, in order to fill the gap between the North and the South, developing countries have relied…

-

CRAFT partner organized lobby meetings in Bangladesh

Campaign for Good Governance (CGG/SUPRO), a partner of the CRAFT program, organized several lobby meetings with tax officers throughout Bangladesh.

-

Fair Tax Monitor country reports launched

The Fair Tax Monitor (FTM) is a unique evidence-based advocacy tool that identifies the main bottlenecks within tax systems and provides strong evidence for advocacy work at national and international level.

-

Launch of the Fair Tax Monitor in Dakar, Senegal

Oxfam and its partner le Forum Civil presented the first report of the Fair Tax Monitor (FTM) in Dakar last Friday.

-

8th CRAFT Strategy Meeting, Dhaka, Bangladesh March 2015

The 8th Craft Strategy Meeting in Dhaka, Bangladesh took place in March. Again it was a valuable and constructive meeting with representatives of all involved organizations attending. Thanks to everybody for their input and effort. The progress of the CRAFT project is the result of a combined commitment to our objectives. This video gives an impression of the…

-

SUPRO and Oxfam about pro-poor tax system in Bangladesh

SUPRO and Oxfam share recommendations for pro-poor tax system with Bangladesh MPs In January this year the Bangladesh Parliamentary Caucus on National Planning and Budgeting hosted a lobby meeting on the 7th Five Year Plan and budget for fiscal year 2015-16. During the meeting, Oxfam and its campaigning partner SUPRO had the opportunity to share…

-

The 8th CRAFT Strategy Meeting Bangladesh 2015

The 8th CRAFT Strategy Meeting Bangladesh 2015 The 8th CRAFT Strategy Meeting will be held in Dhaka, Bangladesh from 10 to 12 March 2015. The first day will be a conference where our CRAFT Participants from 11 countries will be joined by Bangladesh Government Representatives, representatives of diplomatic missions and (Inter)national NGOs. There will be panel…

-

CRAFT Mali Baseline Study 2013

CRAFT Mali Baseline Study 2013 In collaboration with OXFAM, PCQVP (Publiez Ce Que Vous Payez) has commissioned the baseline study on the tax system in Mali. Download pdf This report provides you with information about: Social justice and the situation of the poor in Mali Development of public revenues and the features of the tax structure in Mali the…

-

Regional integrated tax systems needed to curb illicit financial flows

The journalist Patrick Jaramogi covered a joint session of the 7th CRAFT Stakeholder Meeting and ITUC/ TJN-A Tax and Extractives Industries Training that have been held at Lake Naivasha Panorama Park Hotel from 25th-28th June, 2014 in Naivasha, Kenya. African states have the capacity to fully finance their budgets, if they can tame the…