A necessary ingredient for a healthier society. Literally.

Guest blog by Jan-Willem Pot, published to mark International Tax Justice Blogging Day 2016

Before the Ebola outbreak happened, the three worst affected countries, Guinea, Sierra Leone and Liberia, had an average of one hospital bed per 2128 people. Sierra Leone had 136 doctors on a population of 6 million, while Liberia had 51 doctors on a population of 4.2 million. The NGO ActionAid showed that these three countries had spent about $237 million on health while having lost an average of $287.6 million in potential domestic revenue because of corporate tax dodging (using 2011 data).

Photo courtesy: The Daily Signal

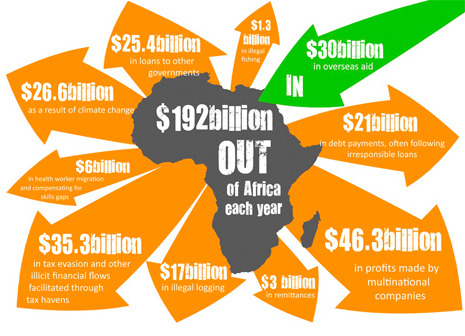

Since I started work at Oxfam Novib, I have had to explain my work and the topic of fair taxation with many of my friends and fellow students. These conversations tend to be extremely interesting and always lead to debates as tax itself is such a politically-laden topic. I noticed during these discussions that most people focus on the unfairness of certain tax practices, like corporate tax dodging, for us citizens of the Netherlands without realizing what harmful effects unfair tax practices can have on those poor living in less developed countries. According to the Washington-based non-profit Global Financial Integrity (GFI), corrupt practices and corporate tax evasion resulted in an outflow of $991 billion from developing countries in 2012.

This non-taxed loss is enormous and makes clear a sad reality:

Developing countries are losing more money to illicit financial flows than they receive in official development aid.

Photo courtesy: www.healthpovertyaction.org

11.1 times more according to GFI, and this does not go without implications for those living in the developing world.

When firms and individuals do not pay their tax, governments don’t collect much needed revenue that could have been spent on public health, basic services, social protection, fighting hunger and other services that could have assisted the already poor and marginalized as well as the general development of nations and their productive workforce. It is this that I find truly unfair. It also is precisely this issue that was underlined a few weeks ago Max Lawson, Oxfam GB’s Head of Global Policy and Campaigns, in his powerful blogpost “My Friend Died Last Week – Tax Could Have Saved His Life”. I encourage you to read his post and see the simple implications that often difficult fiscal policies can have.

First published March 23rd 2015 on http://oxfamnovibacademy.tumblr.com/

#TaxJustice