Category: Africa

-

Driving Gender Equality in Tax Systems Across Africa: Project Updates

Six months into the Gender Equality in Taxation – Fair Tax Monitor (GET-FTM) Project, and tangible progress has been made. Supported by Expertise France, the initiative aims to reduce gender inequalities embedded in fiscal systems in Benin, Cameroon, and Senegal, ensuring tax policies better respond to the needs of women and girls. Since the project…

-

Presentation of the Environmental Taxation Chapter of the Kenya Fair Tax Monitor

On November 20th, at a lively and thought-provoking dissemination workshop, Oxfam Kenya discussed the new Environmental Taxation Chapter of the Kenya Fair Tax Monitor with a range of stakeholders. This was accompanied by the publication of a new study on Regulating Tax Incentives for Enhanced Domestic Resource Mobilization in Kenya. The event—where participants shared insights…

-

Taxing the Rich in Nigeria: How Civil Society Turned Evidence into Action

This interview with Henry Ushie – Programme Manager for Accountable Governance at Oxfam Nigeria – was conducted by Isabel Sánchez Rotllán, Intern with Oxfam Novib When Henry Ushie, speaks about fair taxation, his passion fills the room. “Fiscal governance is my rice and beans,” he laughs. “It’s what I love — ensuring public finance works…

-

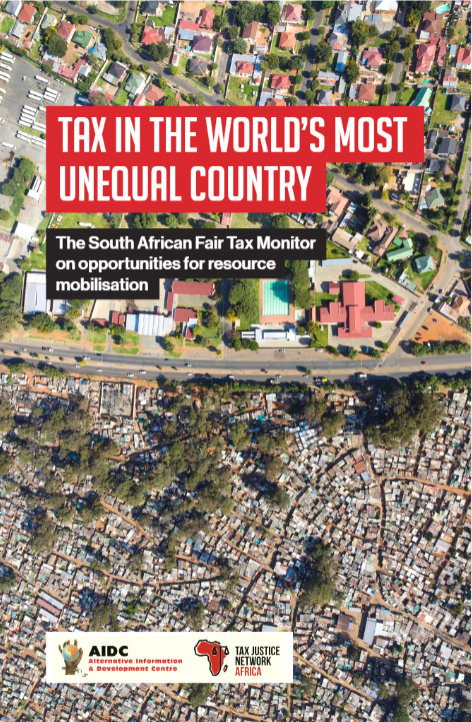

FTM Report South Africa 2025

The Alternative Information and Development Centre (AIDC) has produced a significant amount of analysis on South Africa’s tax system, with a particular focus on personal income taxation and corporate tax evasion. In 2024 the Alternative Information and Development Centre (AIDC) began working on a South African report using the Fair Tax Monitor research methodology, seeing…

-

Fair Tax Monitor delivers training on tax & gender for civil society organizations in Senegal

This blog can also be accessed in French here. Group photo of participants at the training for civil society organizations involved in the Gender Equality in Taxation GET project As part of the ongoing partnership between the Fair Tax Monitor (FTM) and Expertise France through the Gender Equality in Taxation (GET) project, a training event…

-

FTM Partners with Expertise France to Tackle Gender Inequality Through Tax Justice

By Henrique Alencar, Policy Advisor Tax and Inequality at Oxfam and Andrea Salazar Cardero, Intern with Oxfam Novib This article can also be accessed in French here. Building on a decade of dedicated efforts to highlight gender disparities in fiscal systems, the Fair Tax Monitor (FTM) has partnered with Expertise France. Specifically, this partnership seeks to…

-

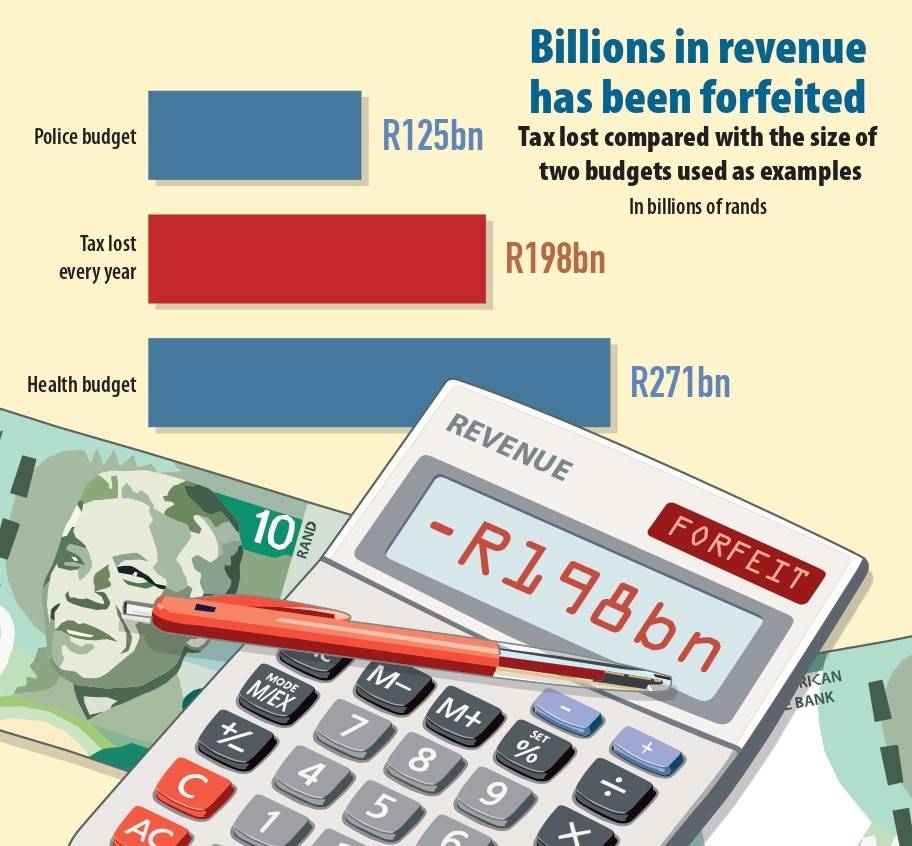

A preview of the South Africa FTM: How the Treasury is forfeiting R198bn a year due to tax bracket over-inflation

By Chloé van Biljon Oxfam Novib and Tax Justice Network-Africa are currently working with the Alternative Information & Development Centre (AIDC) on a South Africa FTM report. The following analysis on the Personal Income Tax brackets of the South African tax system is a result of the research being carried out in preparation of the…

-

What is Nigeria’s path to closing the revenue gap for development?

Following the recent publication of the Fair Tax Monitor Nigeria Report: Taxing the Rich, FTM’s Ishmael Zulu was interviewed for the Business Edge on Nigeria’s national station News Central. In this wide-ranging and comprehensive interview, a number of topics were addressed, such as Nigeria’s critical revenue gap, which threatens its development goals and the stark…

-

New Fair Tax Monitor Nigeria Report: Taxing the Rich to Combat Inequality

On 15th October 2024, the newest Fair Tax Monitor (FTM) report, thematically focused on Taxing the Rich, was launched in Nigeria. It shines a light on a critical issue: how fair taxation of the wealthiest could be the key to tackling the country’s deepening hunger and inequality crisis.

-

FTM Report Nigeria 2024

This is the 2024 Fair Tax Monitor (FTM) report on Nigeria and the first FTM report with the first thematic focus on Taxing the Rich. The report focuses on the yawning revenue gap that threatens the country’s developmental ambitions and the rampant inequality whereby the wealthiest 1% of the population possess five times as much…

-

FTM countries vote in favour of the Terms of Reference for the UN Tax Convention

Image of the final vote results on the TOR for the UN Tax Convention Gaining UN approval for negotiating a legally binding agreement is usually a journey, and often quite a tricky and tiresome one. On 16th August, one such expedition reached a momentous destination however as, in a historic win for tax justice, UN…

-

Oxfam and TJNA Collaborate with AIDC to Explore Fair Tax Monitor Report for South Africa

In a week-long engagement at the Cape Town offices of the Alternative Information and Development Centre (AIDC), representatives from Oxfam and Tax Justice Network Africa (TJNA) visited the Alternative Information and Development Centre (AIDC). The visit marked a collaborative effort to discuss the feasibility of producing a Fair Tax Monitor report tailored to South Africa,…

-

Launch of the Fair Tax Monitor report in Mozambique

“Fair and Efficient Taxation: A Way to Break the Natural Resource Curse in Mozambique?” Today 4 July 2023 the Fair Tax Monitor report was launched in Maputo, Mozambique. Mozambique is rich in natural resources such as coal, gas and minerals. Despite this it has one of the lowest human development index ratings, rankin 185th out of…

-

FTM Report Zambia 2020

This report initially looks at previous fragilities and gives a brief description of the Zambian tax system. It further analyses the pre-Covid tax regime following the 6 clusters of topics: (i) Distribution of the tax burden and progressivity; (ii) Revenue sufficiency and illicit financial flows; (iii) Tax competition & corporate incentives; (iv) Effectiveness of the…

-

TJNA Press Release on AU Experts Meeting on Finances

The Tax Justice Network Africa called for greater focus on untapped assets…

-

African Finance Ministers Sign Yaoundé Declaration

Recently, in the margins of the 10th Global Forum meeting on Transparency and…

-

TJNA’s Africa Media Training 2017

The theme of the 2017 edition of TJNA’s annual Africa Media Training was ‘Harnessing Africa’s mineral wealth to finance sustainable development’.

-

Tax Incentives and the African Education Finance Gap

How much revenue do African governments lose from providing tax incentives…