On April 9th 2024, the FTM team organized a session during which our partner, the Centre for Democracy and Human Rights (CDD), in Mozambique presented their experience of using the new Fair Tax Monitor (FTM) chapter on Extractives.

The session was kicked-off by Adelson Rafael, a colleague from Oxfam Mozambique, who introduced the research and provided essential context.

As Mozambique is rich in natural resources CDD and Oxfam in Mozambique decided to pilot a thematic chapter on tax and extractives in the Mozambique FTM. In order to realize the potential of the extractives sector to generate revenues for the development of Mozambique, an effective system that harnesses this potential is crucial.

Following this context-setting, Henrique Alencar (Oxfam) and Ishmael Zulu (Tax Justice Network Africa) presented the broader FTM methodology and in particular the newly developed Tax and Extractives chapter. The presentation can be found here. Henrique zoomed in on the research framework of the FTM and the historic development of co-creation and fine-tuning of the framework, highlighting the importance of keeping our methodology adaptable and evolving to meet the specific needs of each country, ensuring it aligns with our partners’ work. Following that, Ishmael dived deeper into the tax and extractives chapter used in Mozambique. Ishmael explained that this chapter captures multiple issues related to the taxation and regulation of the extractives sector and also examines how the Africa Mining Vision is adopted within specific countries. More specifically, it focusses on tax expenditures, transparency of ownership, contracts and revenues, Double Taxation Agreements (DTAs), Free, Prior and Informed Consent (FPIC) and revenue sharing mechanisms.

The principal speaker of the webinar was Gabriel Manguele from CDD. His presentation can be found here. Gabriel focused on the outcomes of the FTM research and the main conclusions, recommendations and lessons learned.

Gabriel shared that the combination of qualitative and quantitative questions worked well and that the research was timely because of the current state of play with the natural gas explorations. He added that the engagement with the FTM team, the peer-review process and the stakeholder validation meetings provided great insights. Challenges encountered related largely to the complexity of the research as it covered an extensive number of areas. The extractives part was often separate from the normal tax codes and more obscure requiring additional contextualization which was time-consuming. Furthermore, Gabriel suggested formalizing the scoring for the extractives chapter and providing guidelines for engaging with stakeholders on the scoring process.

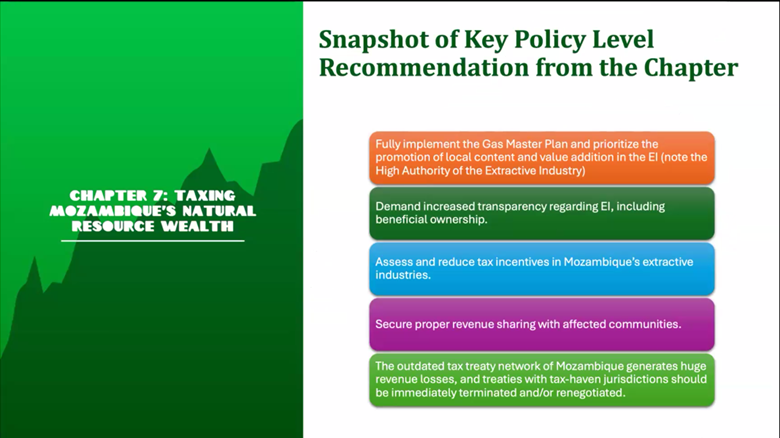

Below is an overview of the main recommendations:

To conclude Gabriel shared how they are socializing the FTM and using the research in discussions and engagement with other CSOs, the government and parliamentarians.

Finally, we rounded up the session with a Q&A and requested all participants to share feedback on the draft tax and extractives chapter with the FTM team which will then be included in the finalization of the chapter for further implementation in other countries.