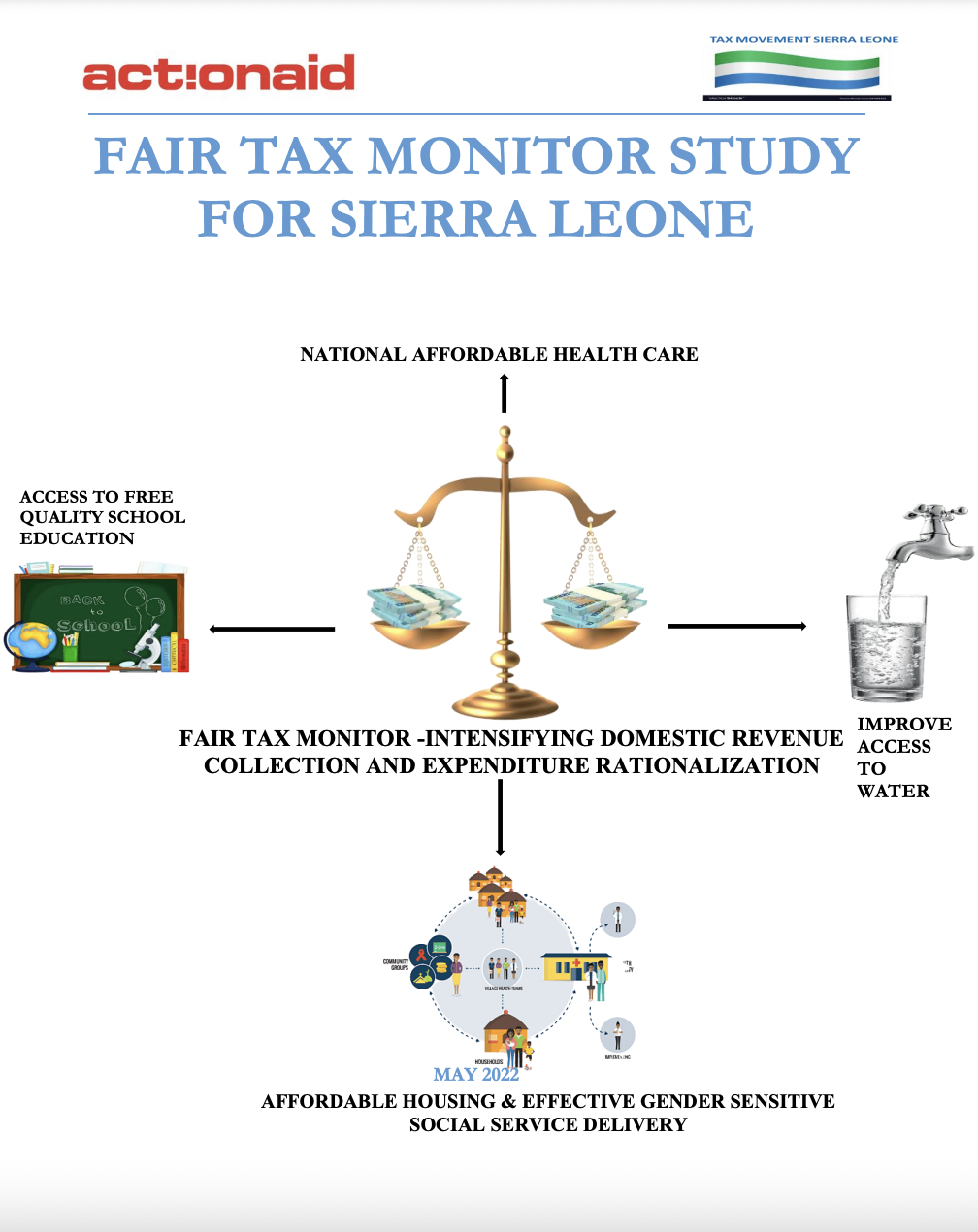

The Fair Tax Monitor is a research, capacity-building, and advocacy tool for fair taxation all over the world.

Here are our latest updates!

Our Impact

CAPACITY BUILDING

20 countries

Co-creation in mutual learning of the FTM methodology.

Support of partner organizations in 20 countries.

Increased capability and confidence of activists to engage dialogue on fair taxation with policy makers.

RESEARCH

Comprehensive freely accessible methodology toolkit for researching fair taxation.

17 published reports in the past 10 years.

Special thematic chapters on Taxing the Rich, Gender & Taxes, Green Taxes and Extractive Industries.

ADVOCACY

Change policies. Change the world.

Greater engagement between policy makers and civil society.

Higher awareness of the gender dimension of tax policies.

Strengthened political will and improved policies to #maketaxfair.

FTM Reports

FTM METHODOLOGY

The Fair Tax Monitor is a unique evidence-based tool that makes it possible to identify the main bottlenecks in national tax systems and to provide strong evidence for advocacy. At the same time, the tool allows for a comparison of tax policies and practices in different countries, using a standardized methodology and unified approach in the research.