By Chloé van Biljon

Oxfam Novib and Tax Justice Network-Africa are currently working with the Alternative Information & Development Centre (AIDC) on a South Africa FTM report. The following analysis on the Personal Income Tax brackets of the South African tax system is a result of the research being carried out in preparation of the report. The full South Africa FTM report is expected to be published in October 2025 as part of the From the Ground project financed by the Finnish Department for International Development Cooperation (FINNIDA).

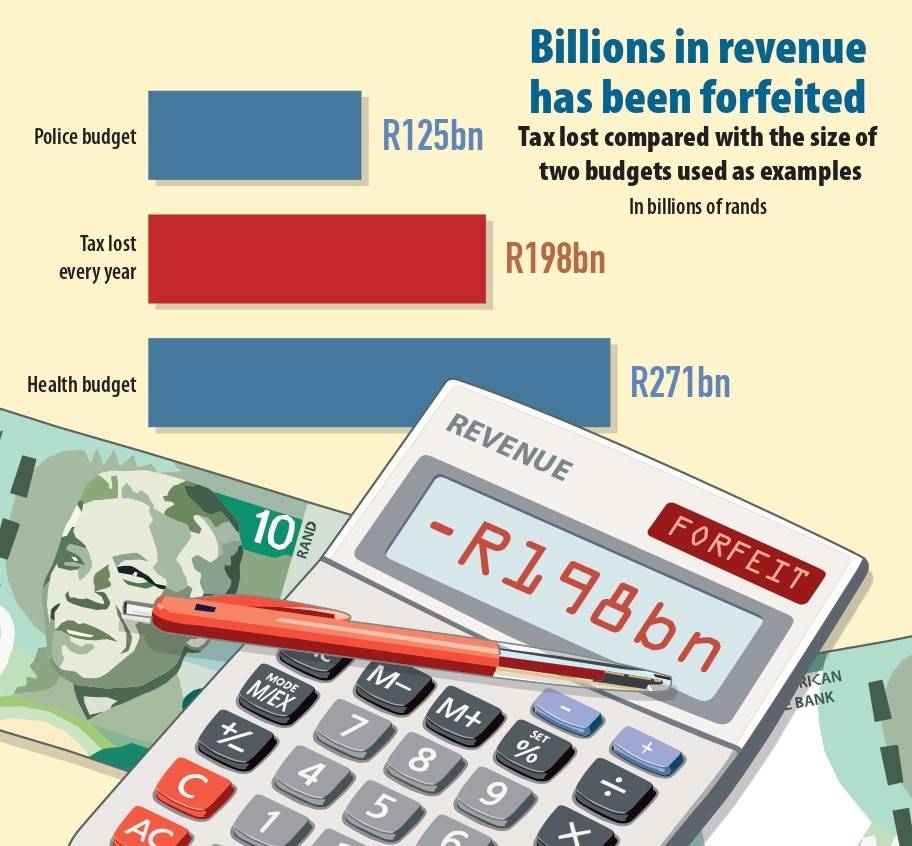

Tax bracket over-inflation has led to income inequality and less money for essential services. Graphic: John McCann/Mail & Guardian

Austerity measures have become a familiar reality in South Africa, negatively impacting public services and impeding prospects for creating decent work. The government argues that reducing spending is necessary, given the high levels of government debt and already stretched resources.

However, a critical examination of our tax system reveals a policy decision that has significantly contributed to this purported fiscal constraint — the over-inflation of personal income tax (PIT) brackets. While intended to mitigate the effects of “bracket creep”, this practice has inadvertently diverted substantial revenue from the treasury, hindering our ability to address pressing societal needs and exacerbating inequalities.

In his 2000 budget speech, then minister of finance Trevor Manuel proudly announced a commitment to reducing the tax burden on “ordinary people”, citing significant income tax relief measures through the adjustment of tax brackets. While this rhetoric sounds appealing, it’s crucial to analyse the actual impact of such policies within the South African context.

“Bracket creep” occurs when inflation pushes individuals into higher tax brackets, even if their real income remains the same.

The South African Revenue Services (Sars) adjusts tax brackets annually to offset this effect. However, for the past three decades, these adjustments have exceeded inflation rates, leading to lower effective tax rates for the same level of real income. While this might appear beneficial on the surface, the cumulative financial impact is considerable.

The two largest contributors to total tax revenue in South Africa are VAT and PIT. While all South Africans pay VAT, given the country’s extreme levels of unemployment and staggering inequality, only the highest-earning 12% of the population, or 44% of the formally employed, pay PIT.

VAT (excluding VAT on luxury goods) is a highly regressive tax, with lower-income earners paying a greater proportion of their income than higher-income earners.

Over and above being a key source of revenue, PIT should play a vital role in the redistribution of income in South Africa. However, the over-inflation of PIT brackets has undermined this redistributive function. Analysis reveals that, had tax brackets since 1995 been adjusted only for inflation, Sars would have raised an estimated R170 billion to R198 billion more in PIT revenue last year alone. This represents a 23% to 27% increase in projected PIT collections.

To illustrate the magnitude of this practice, forfeited revenue is equivalent to 160% of the national police budget (R125 billion) and 73% of the national health budget (R271 billion). This policy’s impact extends beyond budgetary figures. It has profound implications for social equity.

The primary beneficiaries of this tax break are middle-to-high-income earners. Those who fall into lower tax brackets have benefited the least, while those who fall into higher tax brackets have benefited more, with those earning R2 million a year or more facing the largest decrease in their tax liability.

While tax relief is generally welcomed by the public, this particular policy has resulted in persistently high levels of income inequality by diminishing the redistributive capacity of our fiscal system. The impact of this revenue shortfall has translated directly into underfunded schools, teacher job losses, overcrowded hospitals and stretched policing resources. Consequently, the most well off have been contributing less, while the burden of austerity disproportionately falls on those least able to absorb it.

The data underscores this point. PIT revenue as a percentage of GDP, a key indicator of a robust tax system, decreased significantly during the most aggressive implementation of this policy in the early 2000s. Only last year did it recover to its 1999 level. Absent the over-inflation of tax brackets, it is projected that this ratio would be substantially higher. A similar trend is observed in PIT as a percentage of total tax revenue.

While reversing the over-inflation would place a larger tax burden on the 12% of South Africans paying PIT, the additional revenue generated would enable the government to adequately fund essential services.

Paradoxically, improving the quality of public services benefits all South Africans, including higher earners who opt for private alternatives due to the shortcomings of the public system. By strengthening public services, we create a scenario where even high-income earners might find less need for costly private options, creating savings for them as well.

Therefore, we believe in order to protect our domestic resource mobilisation and the redistributive function of tax, the over-inflation of PIT brackets must stop immediately. Continuation of this practice will only undermine the government’s ability to raise sufficient revenue and address the country’s pressing social and economic challenges.

We propose a two-tiered approach to address this issue:

- Lower tax brackets, representing the middle class, should be adjusted for inflation annually to prevent bracket creep, but no more.

- Higher brackets, representing the elite minority, should be adjusted by less than inflation to rectify the over-inflation that has occurred over the past 30 years and to decrease the shocking levels of inequality.

This analysis necessitates a critical reassessment of our tax policy. While addressing bracket creep is a legitimate concern, the current approach has demonstrably resulted in significant revenue loss, a weakening of our redistributive mechanisms and, ultimately, a perpetuation of inequality.

The legacy of apartheid has left deep scars of systemic enrichment for some and marginalisation for others. Thirty years later, inequality persists. A well-functioning tax system is essential for addressing this by funding crucial public services like schools, hospitals, policing and infrastructure.

These services are not merely government expenditures; they are fundamental to realising basic constitutional rights and improving the lives of all South Africans, especially the most vulnerable.

A strategy is required that balances the need for fair taxation with the imperative to generate sufficient revenue to fund public services and promote a more equitable society. The substantial fiscal and social implications of tax bracket over-adjustment demand a comprehensive and transparent public discourse.

It is not simply about tax relief but about building a more just and prosperous South Africa for all.

ENDS

For more information, see the Alternative Information & Development Centre’s (AIDC) research on bracket over-inflation.

Chloé van Biljon is a Tax Justice Project Officer at AIDC