Guest blog by Andrea Brouwer, published to mark International Tax Justice Blogging Day 2016

Eric Wiebes of the Ministry of Finance has written a letter to multinationals who wish to settle in the Netherlands. He warns them not to have high expectations of generous tax benefits. “Please take sober state support into account.” Wiebes wrote to the multinationals. “Due to the strict control by the European Commission, we are limited in our capabilities. The tax benefits can therefore be quite disappointing.” The letter is distributed in mailboxes on the Zuidas in Amsterdam.

Wiebes says he wants to use the letter to clarify. “It is not a pleasant message, but companies need to know where they stand. If they do need to pay taxes, they better hear it now than in a few years, when they have spent it all on bonuses, cheat software and nasty coffee flavors.” The lower House is pleased with the letter, however some politicians find the tone somewhat detached: “It looks a bit like Wiebes wants to send the message that shelf companies are not welcome here. That can never be the intention.”

As you probably noticed this article isn’t based on facts. It was written on the Dutch website De Speld a while ago. This is a satirical online news magazine. They respond to regional, national and international news with a wink. This article points at the news items of November which told that The Netherlands gave illicit state support to Starbucks. The European Commission is researching a few fiscal deals between multinationals and countries. About a month ago they released their research into Starbucks. It turned out that Starbucks paid far less tax than you might expect looking at their profits. A preliminary calculation showed that Starbucks paid 1.2 million euro income tax over three years, while The Netherlands was supposed to receive between 20 and 30 million euro’s. Starbucks lowered their profits by selling beans from one affiliate to the other for a high price which reduced the profits and therefore tax on profits. Besides that Starbucks paid the so called royalty’s to a mailbox company of Starbucks in Great Britain. Those royalties are costs for the use of intellectual property. Those royalties didn’t reflect the market value and were therefore illicit. The Commission concluded that there had been illicit state support from The Netherlands

Last Friday Wiebes announced they are going to appeal against this decision of the European Commission. Wiebes states that the deals with Starbucks are in line with the guidelines of the OECD (Organization for Economic Co-operation and Development). According to him, Brussels did not convincingly demonstrate that the Tax Authorities of the Netherlands diverged from the statutory rules, and that there is existence of State aid. The decision of the European Commission didn’t match the guidelines from the OECD, which creates indistinctness and uncertainty. He states that the state wants clarity and jurisprudence and therefore appeals to the decision. Wiebes leaves a special note that he fully endorses the international fight against tax evasion by multinationals. Unfortunately this message isn’t from the speld.nl.

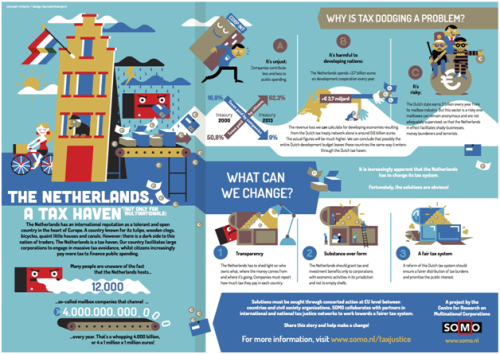

Credits: www.somo.nl

At first I was surprised that there isn’t really a risk in providing illicit state support for countries which make those deals with the multinationals. “The worst case scenario” for the countries is that the European Commission finds out and the multinationals still need to pay tax they owe the government. However this appeal from Wiebes surprised me even more. Wiebes does support the international fight against tax evasion however he appeals against the decision of the European Commission.

Is the need for clarity and jurisprudence indeed for real or is our government acting a bit hypocritally? Room for thought I would say.

References:

http://www.nu.nl/ondernemen/4173195/kabinet-in-beroep-Starbucks-uitspraak.html

http://speld.nl/2015/10/23/staatssecretaris-waarschuwt-bedrijven-voor-sobere-staatssteun/

First published December 23rd 2015 on http://oxfamnovibacademy.tumblr.com/

#TaxJustice